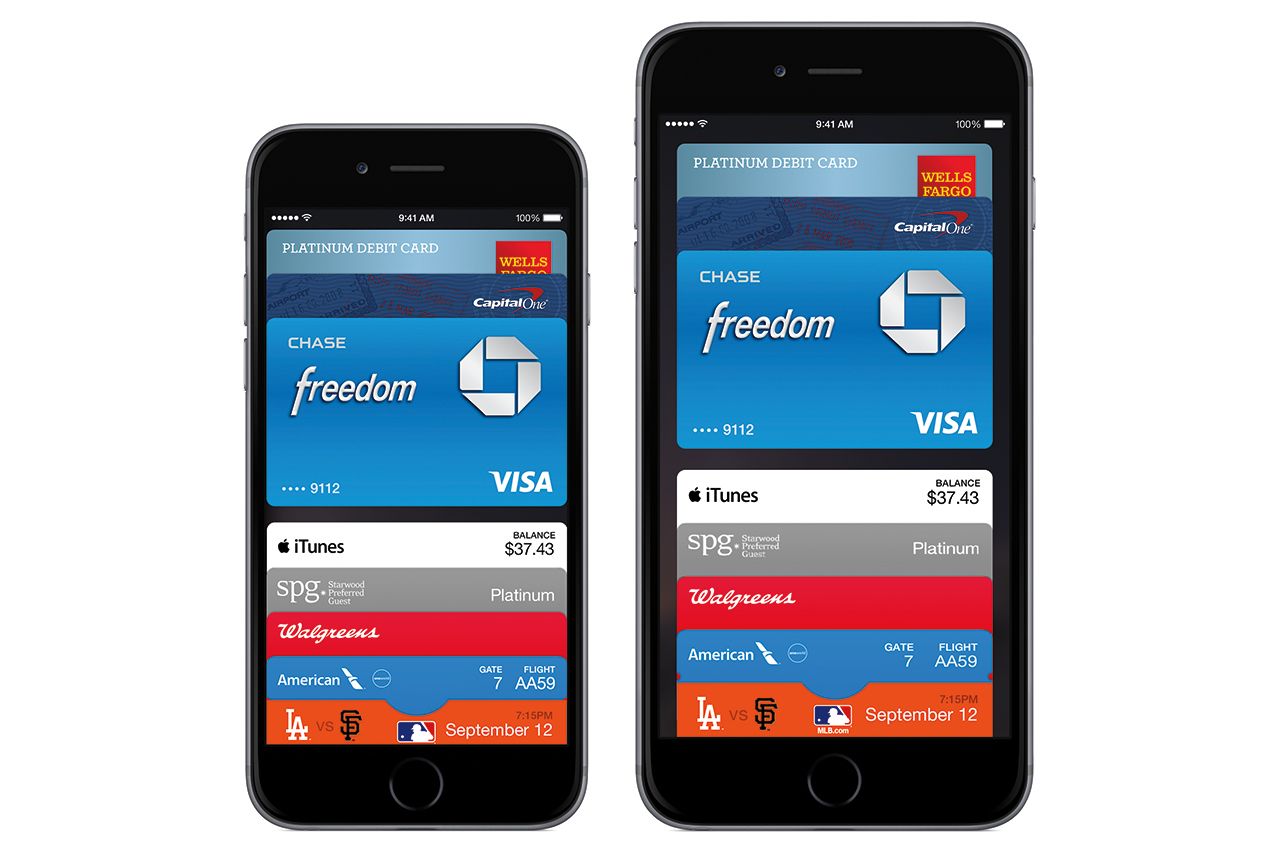

Apple has announced Apple Pay as its way of improving and replacing the wallet.

Apple Pay will only work with the iPhone 6 and iPhone 6 plus as it will use NFC to deliver payments. In store it will work much like contactless payments work now with a simple tap to pay.

In the US 220,000 merchants are on board so far including Walgreens, Macs, Staples, Whole Foods and more including Disney before Christmas. Crucially 80 per cent of credit card companies are on board including Visa, Mastercard and Amex.

The user's credit card details aren't actually stored on the device itself meaning it's secure. Instead, that information is kept in Passbook, ripping that information out of your iTunes so it's even easier.

Apple assures users that it won't know where payments were made or for how much. Touch ID is also used to enhance the security of the payments - meaning the owner's fingerprint is required to validate the one touch payments. If this proves as secure as it seems it will mean payments of higher amounts that current credit cards with contactless are limited to.

Like one-click for Apple there can be one touch payments made for online checkout payments too.

Uber will come built into the app so it works directly from the phone.

Apple Pay will launch in the US this October. A UK release date has not been announced yet.