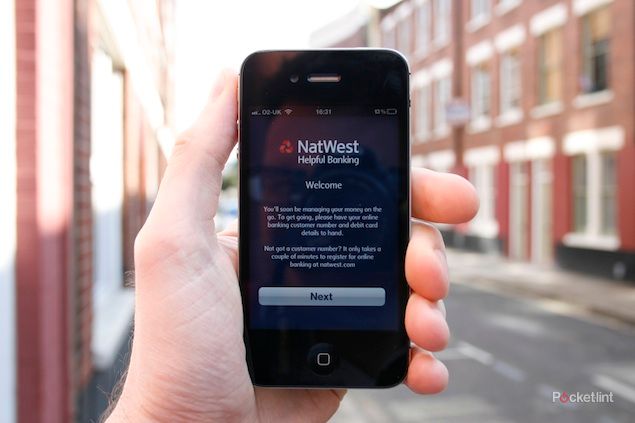

RBS and NatWest customers can now leave their wallet behind and still withdraw money via their smartphones’s banking app.

Cash withdrawals of up to £100 can be made by making the request through the RBS and NatWest app, which will in turn send a six-digit pin number to the user's phone.

They can then type the pin code into the ATM before receiving the money, just as you would if you had used your cash card.

RBS is calling the scheme GetCash and it should prove not only useful for customers who lose their cards or forget their wallets, but also for worried parents.

Parents who need to get money urgently to their son or daughter can simply forward the pin number and they’ll be able to withdraw the cash themselves.

Each code is valid for three hours and so long as they don’t go over their daily withdrawal limit, customers can use GetCash as many times as they like, with each withdrawal limited to a maximum of £100.

The NatWest and RBS app is available to download free for the iPhone, iPad and Android and BlackBerry smartphones.

GetCash is yet another way in which mobile phones are being used as ways to conduct monetary transactions. NFC continues to be trialled while PayPal recently unveiled a new app that allows contactless transactions in select retailers.

Will you use RBS and NatWest's new cardless cash withdrawal system? Let us know what you think.