Samsung has updated its Samsung Pay service with two new features, including a prepaid cash card. Here's how that works.

What is Samsung Pay Cash?

Samsung Pay Cash is a new Samsung device feature that allows you to create a virtual debit card that's stored in the Samsung Pay app. With Pay Cash, you can add funds to the card (either with an existing card in the app or by transferring funds directly from a bank account), and then you can make purchases both online and in stores, without exposing your card number.

Think of it as a prepaid cash card, only it lives in your Samsung Pay account wallet. It works anywhere Samsung Pay and Mastercard are accepted and is secured via Mastercard's tokenisation service. Just add money to it and shop while earning Samsung Rewards points. You can also use the feature to send money to friends and to request money back.

Who can use Samsung Pay Cash?

You must be a US resident and at least 18 years of age or older. Oddly, Vermont residents are ineligible to open or register Pay Cash.

Which devices support Pay Cash?

Samsung Pay Cash is supported by any Samsung device that can run the Samsung Pay app. Here's the full list of supported phones:

- Galaxy S10, Galaxy S10+, Galaxy S10e, and Galaxy S10 5G

- Galaxy S9 and Galaxy S9+

- Galaxy S8 and Galaxy S8+

- Galaxy S7, Galaxy S7 Edge, Galaxy S7 Active

- Galaxy S6, Galaxy S6 Edge, Galaxy S6 Edge+, Galaxy S6 Active

- Galaxy Note10, Galaxy Note10+, and Galaxy Note10 5G

- Galaxy Note 9

- Galaxy Note 8

- Galaxy Note 5

- Galaxy Fold

How does Samsung Pay Cash work?

Enroll in Pay Cash

While setting up Samsung Pay or adding payment cards within the Samsung Pay app, tap Get Samsung Pay Cash to enroll in Pay Cash. You will be asked to provide your first and last name (as it appears on your driver’s license or identification card), as well as your physical address, email address, year of birth, and a mobile phone number capable of receiving text messages.

Access Pay Cash

Once enrolled, you can view Samsung Pay Cash from the Samsung Pay app on your device. Simply open the Samsung Pay app, tap Menu (the hamburger menu in the upper-left corner), tap Cards from the home page or main menu, and tap Samsung Pay Cash to view the card.

Once you open a Samsung Pay Cash card, it is added to your Samsung Pay wallet on your device. When making purchases, if you do not see Samsung Pay Cash as a payment method, locate the Samsung Pay Cash in the card section of the Samsung Pay app. Then, from the Card details page, tap More Options (three vertical dots) at the top right, and tap Add to Favorite Cards.

Adding funds to Pay Cash

You can add funds to Samsung Pay Cash via one of the credit or debit cards you have already added to Samsung Pay. To get started, open the Samsung Pay app and go to Samsung Pay Cash on your phone. Tap Add money, enter an amount (minimum is $10), select a card to pull money from, and tap Next to review your transfer information. Tap Add money and confirm your transfer request.

You will need to verify your transfer with a PIN, fingerprint, or iris scan. If your request is approved, you will receive an email notification.

Alternatively, you can also add funds from your bank to your Samsung Pay Cash once you have a fully registered account. To get started, open Samsung Pay app on your phone, go to Samsung Pay Cash Account, tap Add money , and then tap Bank transfer. You can start a money transfer from your bank to your Samsung Pay Cash using your routing number and account number.

Sending or receiving funds in Pay Cash

To send money, select Samsung Pay Cash within the Samsung Pay app, tap Send, and select one of your contacts or enter their phone number manually. Enter the amount, confirm it and the recipient information, and then tap Send. If the recipient does not have a Samsung Pay Cash, they will need to sign up for a Samsung Pay Cash Account. Otherwise, the transaction will remain pending.

To request money, select Samsung Pay Cash within Samsung Pay, tap Request, select one of your contacts or enter the name and phone number manually, enter the amount, confirm the amount and recipient information, and tap Request. Again, the recipient of your request must have a Samsung Pay Cash. After five days, the transaction will expire if it is still pending.

What is a Samsung Pay Cash Lite account?

If you see that your new Pay Cash account is marked as a Lite, you can still add funds, send funds through P2P, and make online and in-store purchases, but you'll need to register your account for full access. The US federal government requires more information, like your birth date and social security number, to provide access to certain financial products and services.

Lite and Full accounts have different limits:

Lite accounts

- Limited to loading or receiving money one time.

- Daily: up to eight transactions with a max total that is not to exceed $500.

- Weekly: up to 10 transactions with a maximum total that is not to exceed $500.

- Monthly: up to 15 transactions with a maximum total that is not to exceed $500.

Full accounts

- Able to load or receive funds multiple times.

- Daily: up to eight transactions with a max total that is not to exceed $1,500.

- Weekly: up to 10 transactions with a maximum total that is not to exceed $2,500.

- Monthly: up to 40 transactions with a maximum total that is not to exceed $3,500.

Is that it?

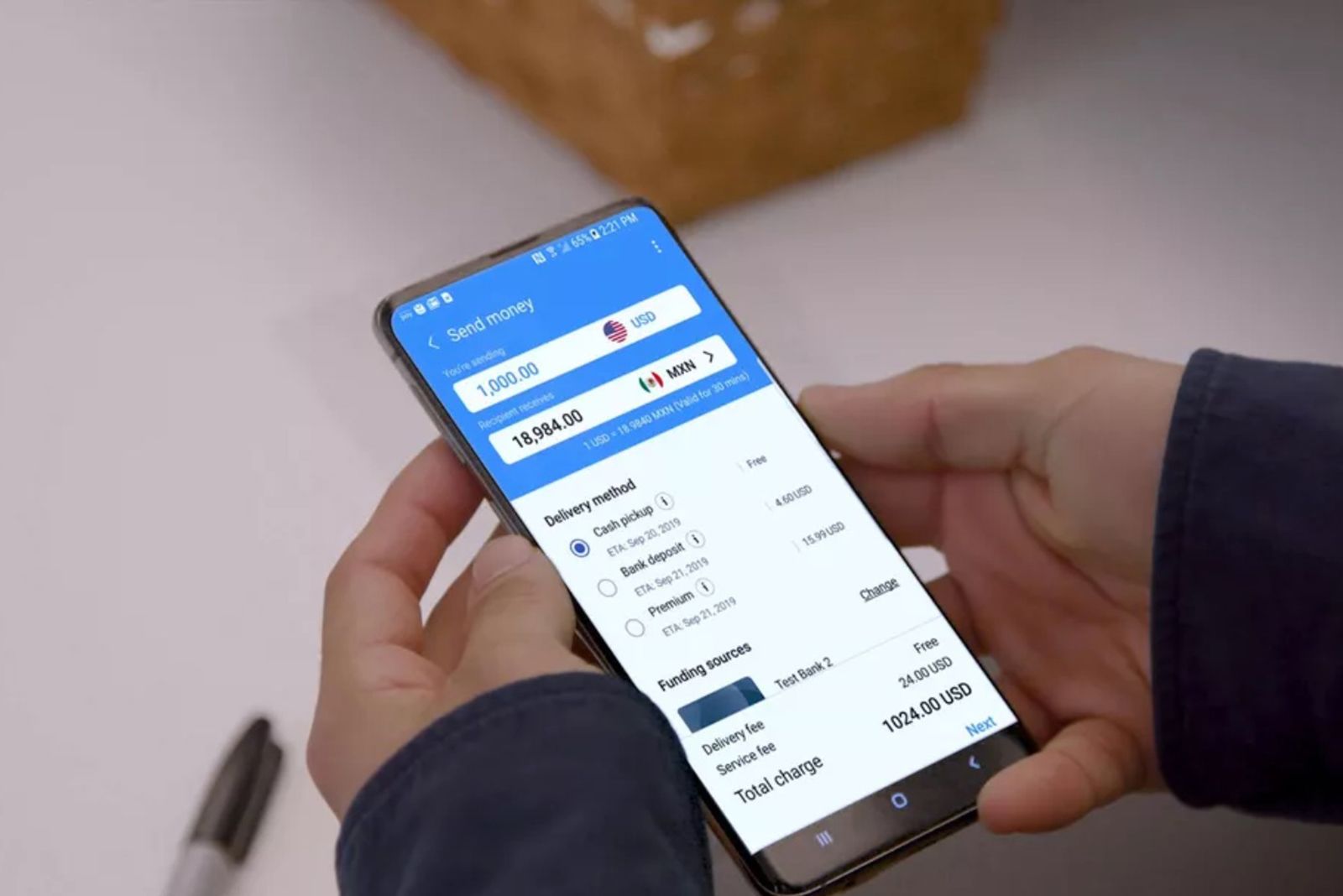

Nope. Samsung Pay has another new feature: International money transfers, in partnership with Travelex. US Samsung Pay users can send payments to 47 countries using their existing pre-registered debit or credit cards. They can send money in most major currencies.

Money Transfer is now available in the US and should expand to more regions in 2020.