How much did you spend on groceries or eating out last month? Most of us could probably, at a push, happily tell ourselves a rough estimate of our regular recurring household bills. There’s the mortgage or rent, your phone bill or the gym, but it's the other things, according to money app Yolt, like a morning coffee on the way to work that can soon rack up across the month without your realising.

Yolt, a new app from a Fintech company owned by Dutch bank ING, takes a rather different approach to helping you manage your money. Rather than insist you've got to move all your bank accounts to the company's own offering, it allows you to simply "connect" your bank accounts to the money app to help you analyse how you spend your money.

View your accounts together

In the UK the app works with all the major high street banks including Barclays, RBS, HSBC, Santander, Natwest, and many others. The app works by using your usual online banking details to connect to your bank using the same double encryption security solutions the banks do, but the benefit here is that it allows you to view multiple accounts and your spending data from multiple banks at the same time. That's really handy if you shop with a joint account from one bank and a personal account from another.

Transactions and categories

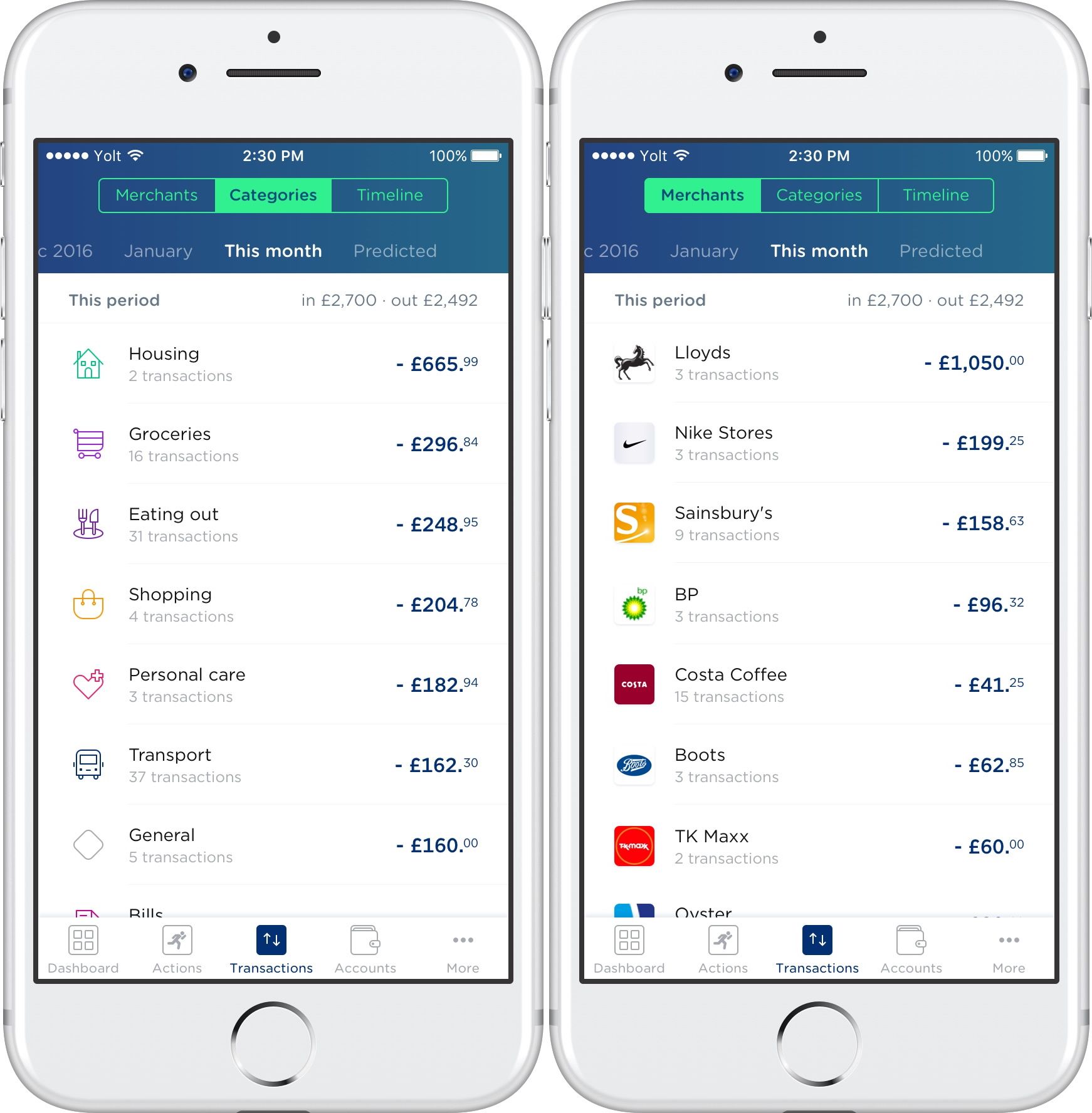

Once you've imported your banking history into the Yolt app, the app will go about categorising your data into useful buckets so you can quickly get an idea of what you are spending your money on.

The categories include things like "Shopping", "Eating out", "Housing", "Bills" and "Groceries", and the app starts by trying to auto associate things you've already bought to those pre-defined sections.

The transactions it doesn't know about get assigned to a "General" category and you can then manually adapt and change the status of individual transactions as you like. Thankfully, the system is clever enough to understand that you'll want to change all references of that store to that category too.

Smart money insights

Just telling you you've spent £12.54 at WH Smiths isn't really going to help you budget your money more wisely, but by analysing your spending habits the app can, and will, start to create interesting insights about your money and spending.

This ranges from what your account movements were last week (incoming, outgoing, saving) to telling you which categories you spent the most on. It even goes so far as letting you know who you're spending the most money with, while giving you a quick view of your top categories.

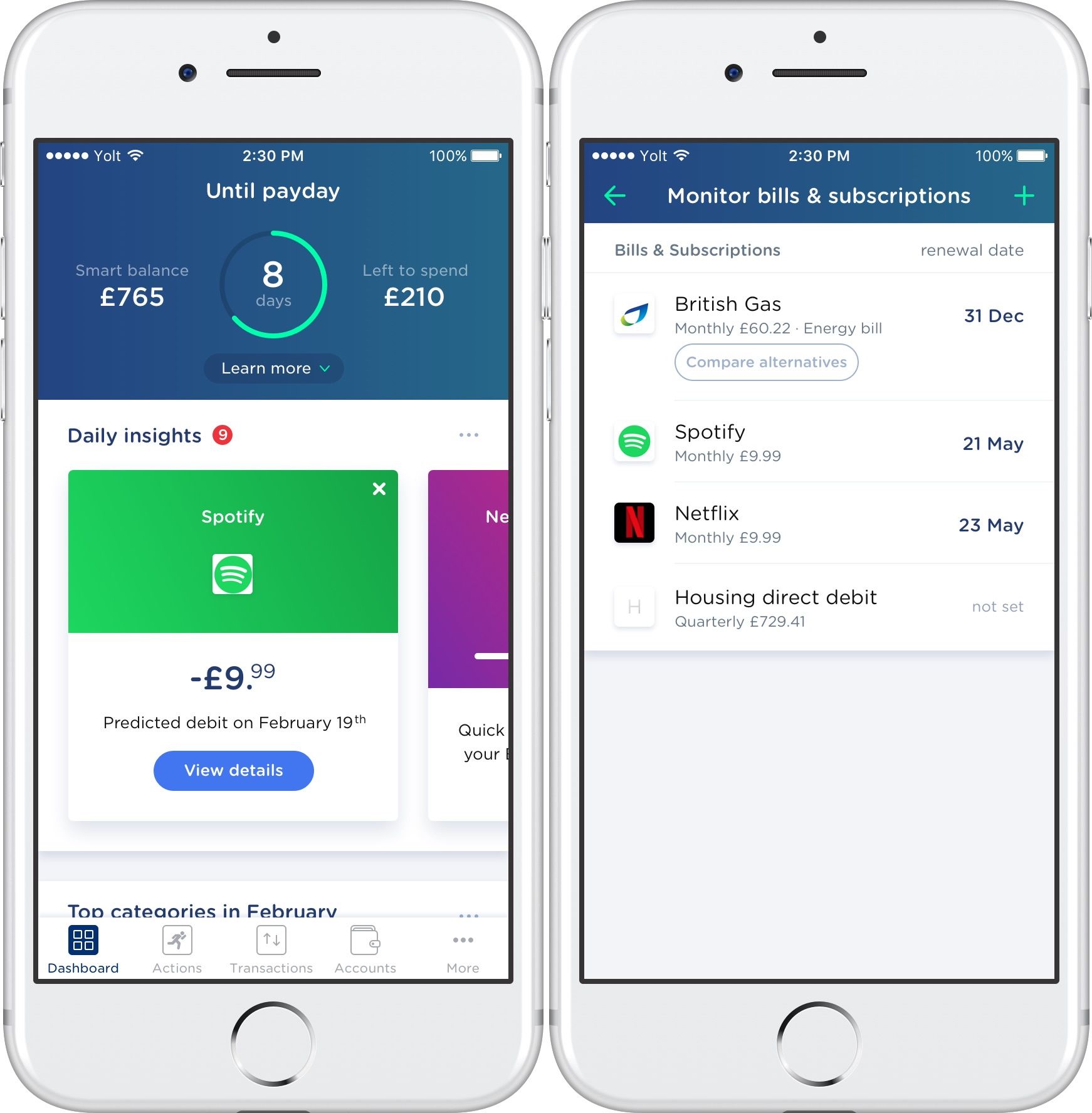

The app will even go one step further by suggesting how much you've got left to spend overall this month, while a "Smart balance" feature takes into account expected bills that you've not yet paid.

Compare subscriptions and energy deals

The Yolt app also lets you monitor your bills and subscriptions all at once from within the app allowing you to quickly compare energy deals across the top UK providers, so you know where to save and how. Whether it's getting money off your gas bill or simply helping you remember when your contract renews, it's a quick and simple way to track your regular subscriptions.

Actions

You can use the app to set and track budgets, monitor your bills and subscriptions and look for better energy deals. The budgets feature is particularly handy if you are trying to keep to a set budget within a category like "Eating out" or "Cash".

By setting a target it will keep track of how much you spend over the month and quickly let you know how much you've got left to spend at any given time when you log in to the app. Obviously, you can choose to ignore the suggestions - this is just reading your banking details after all - but it should help those worried about living beyond their means and let them plan accordingly.

Private and secure

Backed by Dutch bank ING, a bank that has 36 million customers in 40 countries, Yolt uses bank level security to keep your information protected. Furthermore, the app itself is password protected either via a five-digit PIN or for Apple devices: TouchID.

The company states on its website that it will only use the information that you agreed to share with it to further develop the app and provide other useful services to you and that they do not sell your data.

Getting the app

The Yolt app is available for download on both the Apple App Store and Google Play. Yolt is compatible with iPhone devices (iOS 9.0 or higher) and Android (4.4 or higher).