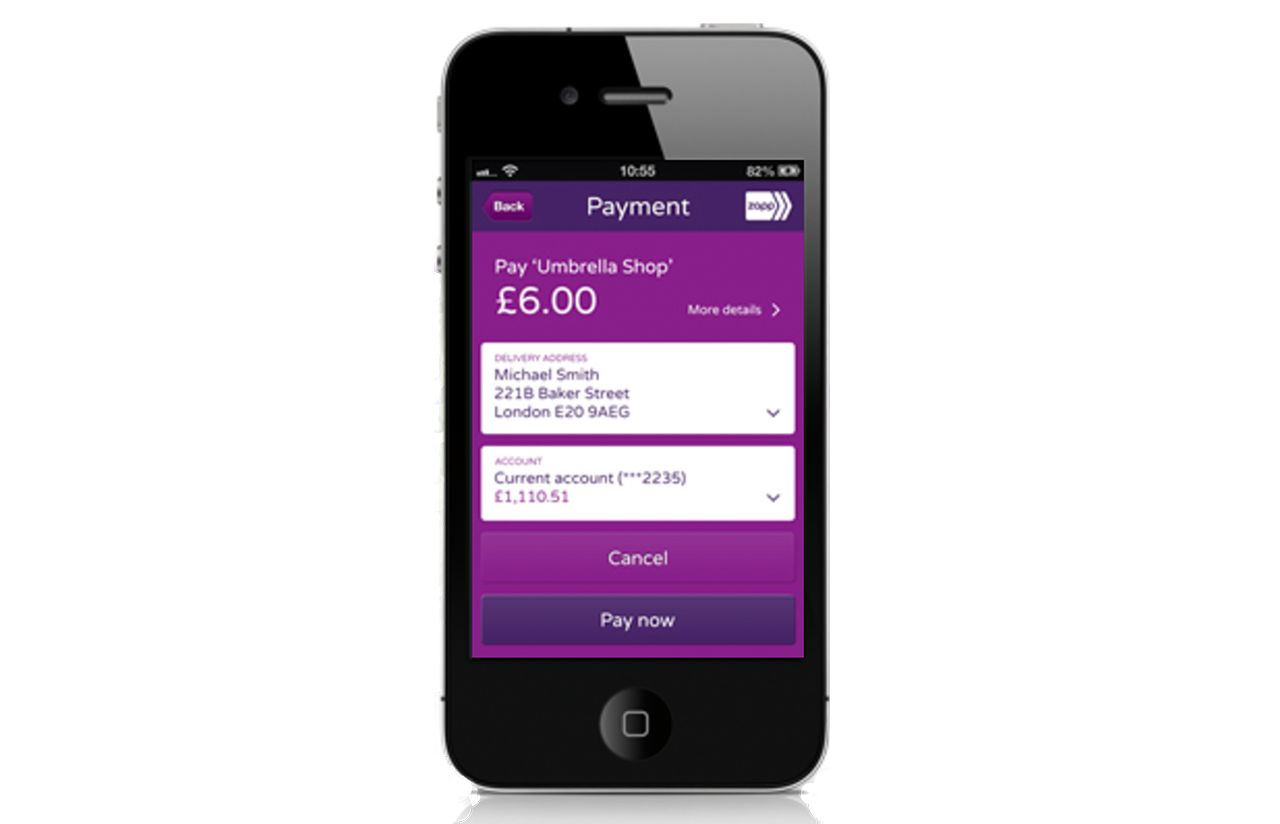

A soon to be launched app called Zapp hopes to streamline the way mobile payments are managed. Vocalink, which is believed to be owned by a range of high street lenders, is looking to re-invent the way consumers make instant payments using the Zapp app.

Planned for launch early next year, Zapp allows you to instantly make a payment from your bank account using just a mobile phone number. So far it has secured £16 million in funding, but will be looking to reach around £100 million for its launch in 2014.

The idea is that mobile phone networks and retailers will all be offered up to a 10 per cent stake in the Zapp app. VocaLink already manages more than 90 per cent of UK salary transfers and deals with things like household bills and even Direct Debits.

Getting VocaLink involved is a major breakthrough for the Zapp app as it shows to retailers and bankers the importance of the new mobile payment system.

Zapp works by linking your bank account directly to a mobile phone number. This in turn helps speed up payments and transfers to small businesses. The aim ultimately is to introduce one unified cross-bank system not unlike Barclay's own PingIt app.

The government recently issued a final report from the Parliamentary Commission on Banking Standards which suggested retailers should allow smaller businesses the ability to deal direct with retailers, simplifying the payment systems.

"The current arrangements, whereby a smaller bank can only gain access to the payments system via an agency agreement with one of the large banks with which it is competing distort the operation of the market," explained the report.

"The Government's proposed reforms will, however, continue to leave ownership of the payments system largely in the hands of the large incumbent banks.

"Continued ownership of the payments system by the large banks could undermine the proposed reforms, in view of the scope such ownership gives them to create or maintain barriers to entry," it added. "The Commission therefore recommends that the merits of requiring the large banks to relinquish ownership of the payments system be examined and that the Government report to Parliament on its conclusions before the end of 2013."

Expect more on Zapp as its development process approaches completion. If all goes to plan, we should have a final version of the app available by 2014.