With an insurance quote in hand, every random car owner is tempted to think just in terms of cost and forget about every other detail. But here's the catch: You can learn a lot about the policy's coverage, the company's payment limits, and your financial responsibility for filing a claim by comparing insurance quotes.

Besides, one of the most effective money-saving strategies is to compare rates from various insurers. It doesn't require a lifetime. You can save money on auto insurance and get a policy that fits your needs with just a little bit of research.

Having no idea where to compare car insurance quotes? mInsurance is a perfect choice for that. You’ll find all you need to know about cheap car insurance quotes in this mInsurance overview, including the attractive perks that come with comparing with mInsurance.

What does mInsurance do?

With mInsurance's assistance, you can find out cheap car insurance quotes for free with simply a few clicks. You provide some basic details about yourself and your needs, and they provide you with a quote for the insurance you're interested in.

Regardless of your car's model, mInsurance will get you several low-cost insurance rates. provide a comprehensive comparison service that includes providers from every state in the United States. Simply enter your zip code, and you'll get local price estimates.

What are the pros and cons of mInsurance?

In case you're in doubt, you could look up the following pros and cons of mInsurance to help your choice.

Pros:

Below are some impressive perks of shopping for insurance quotes with mInsurance.

Low-cost insurance premiums

It gets insurance quotes from a wide variety of firms. And, of course, reviewing multiple quotations is the greatest way to find the most affordable option.

Free services

There are no covered or unseen fees for using the company's services. All quote comparisons are free of charge at mInsurance.

Quick application process

The process of obtaining auto insurance rates online is quick and easy, and all you need is a couple of basic information.

Comprehensive information

There are quite a number of car advice, tips, and answers on mInsurance. For any questions about a certain brand of car, for example, an Audi vehicle, you can browse mInsurance for the car's further information.

Protection of sensitive data with encryption

Your personal data will never be shared with anyone. mInsurance takes data security very seriously and implements safeguards similar to those used by banks to prevent data loss.

Cons:

In the same way, using mInsurance has a few disadvantages. However, the merits far outweigh these demerits.

Unavailability outside the US

If you need an insurance premium for your vehicle but live outside the United States, you may not be able to take advantage of mInsurance services. The services are restricted to states in the US.

Comparatively low pool of direct insurers

Since mInsurance is a new website, it may not have as many connections with direct insurers as other well-established companies may have.

What to provide to get free car insurance quotes on mInsurance?

Quote services at mInsurance are as seamless as they are free, but they do require the following:

- Details of the car: The company needs to know the manufacturer, model, and other necessary details about your vehicle.

- Personal information: To get customized prices, you'll need to supply some personal information like your age, name, residence, gender, and marital status.

- Contact details: If you want mInsurance to contact you with more information on affordable insurance quotes, share your direct contact and email address.

- Log of driving history: Your past record as a driver is also a requirement. If you've had an accident or you've been charged with DUI in the past three years, the firm needs to know.

- Usage information: It also wants to know what you do with the car. Consider factors like how often you plan to wash the car and whether or not you use the vehicle for business when deciding.

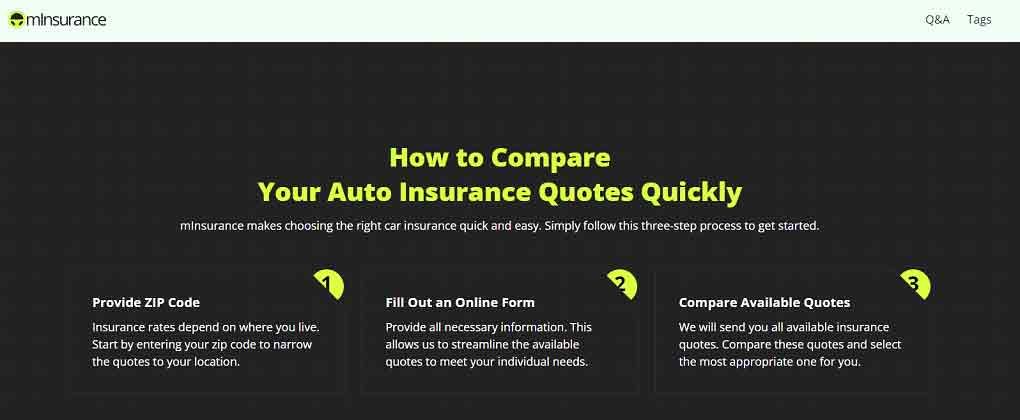

How to compare your car insurance quotes for free by mInsurance

mInsurance streamlines the process of finding affordable car coverage without a cost. And for a fact, you can get started by simply following these three easy steps.

- Enter your Zip code: Insurance premiums are determined by a variety of factors, including your location. To begin receiving quotes that are specific to your area, simply enter your zip code.

- Fill out the required online form: Be as detailed as possible. This makes it possible for mInsurance to tailor the estimates it provides to your specific requirements.

- Obtain multiple estimates and evaluate each one: You can get any and all insurance quotations the company has access to without hassle. Look at the several estimates and go with the one that best fits your needs.

mInsurance alternatives

If you want something different from what mInsurance offers, here are a few alternative websites you could try out to get car insurance quotes.

Insurancey

Insurancey is a great mInsurance alternative that can be used for free car insurance quotes. Using its services, you won't have to shell out as much on auto insurance. Auto insurance estimates are also available in record time.

With Insurancey, you may get insurance prices and initiate coverage all from the convenience of your computer. Every step of the process is simple and straightforward.

Insurancely

Insurancely is a particularly great option for young drivers. Like mInsurance, it saves you the stress of making urgent decisions.

You can check how various options stack up against one another by looking at the costs and user ratings. You can also compare auto insurance estimates and policies from leading insurers without a cost.

Allstate

Allstate insurance covers more than your vehicle alone. To keep moving forward, you need both the individualized assistance of agents and cutting-edge solutions like Drivewise.

Allstate agents are available to offer guidance on key coverage decisions, address concerns, and otherwise streamline the process. As your needs and circumstances change, it may help you take advantage of any applicable vehicle insurance savings and make necessary policy adjustments. It is also able to help you with filing a vehicle insurance claim.

Conclusion

There’s no doubt that comparing quotes from multiple auto insurance providers is essential before making a final decision on coverage. With mInsurance, you may get numerous low-cost insurance quotations for any model or make of vehicle.

Are you in search of reliable auto insurance providers to safeguard your investment? Give mInsurance a try.

This is a sponsored post. The product choices and opinions expressed in this article are from the sponsor and do not reflect the editorial direction of Pocket-lint or its staff.